In the midst of the COVID-19 pandemic, the U.S. government has developed a $2.2 trillion economic recovery package. In an effort to prevent a permanent or drastic economic fallout, the new law will provide quick cash to Americans, as well as tax breaks and loans for businesses across America. Yet, despite the initial shock of how large the stimulus package may seem, the program excludes many Americans in-need. One of the most notable of these groups are college students.

Eligible Americans will receive a one-time $1,200 check to ease financial burdens during the pandemic. The IRS describes this group as those who have a social security number, have filed taxes in 2018 or 2019, earned less than $99,000 for single filers, $136,500 for heads of households or $198,000 for married filers or are not claimed by someone else as a dependent. The latter qualifier is what prevents so many college students from receiving a check this month.

Taxpayers are allowed to claim anyone under the age of 24 as a dependent, and many parents of college students often claim their child for tax breaks and higher tax returns. However, that college student can then not claim their $1,200. Additionally, Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center, states that even college students who are not claimed as dependents are not eligible for payments.

The COVID-19 pandemic has left many Americans in troubling and difficult positions. But for college students, the little aid the U.S. government has to offer will remain out of their reach. For students who have been kicked out of their dorms, or have lost their on-campus jobs, this may be detrimental.

Further, a study by PEW research found that the 19.3 million young working Americans, ages 16 to 24, will be disproportionately affected by COVID-19 layoffs. The current numbers estimate nearly half of this population, which comes to around 9.2 million workers, work in service-sector jobs and another fourth work in higher-risk industries.

Despite being disproportionately affected by COVID-19, college students are neglected by government aid, and there seems to be no provided reasoning by the IRS or U.S. government as to why this is. Hypothetical reasons could include that claimed dependents are not viewed by the American government as the ones responsible for paying for their livelihood, or an argument that they could simply return home. Yet, this is often not the reality. Many college students who are claimed as dependents still pay rent, accumulate student debt and are responsible for providing for themselves. Additionally, the option to return home is not plausible for college students who come from high-risk communities, face unsafe home conditions or simply can’t find a way out of their lease.

For University of Maine students, the latter reality was evident in the first few weeks after the University of Maine System announced the switch to online learning after spring break. Facebook pages dedicated to UMaine classes were flooded with posts from students looking for someone to take over their lease so that they may return home.

If these students were not able to find anyone to take over their lease, they are still responsible for monthly payments. And this is an issue that impacts more than just Maine college students. Despite the current nation-wide plea for landlords to freeze rent payments or cancel utility bills, only Lewiston and Portland have called for landlords to delay evictions, and Maine currently has no state-wide initiative for rent freezes or evictions.

Instead, Maine has partially halted eviction court proceedings through May 1, except for those that fall under “compelling reasons.” Most recently, Gov. Janet Mills denied a bill requested by a petition circling around the state for Maine to suspend all rent, mortgage and utility payments during the pandemic. Instead of ignoring citizen requests, Maine needs to follow the lead of other Northeast states such as Delaware, who have gone beyond state-wide freezes and have announced that they will begin offering cash assistance to renters affected by the pandemic.

Yet, the bottom line is that Maine college students, and college students across the country, are not eligible for the $1,200 checks other rent payers will receive, and are left to find ways to pay rent on their own.

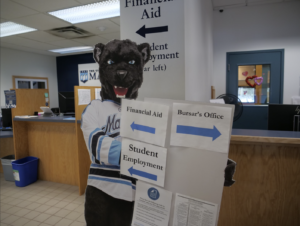

On the positive side, students of UMaine are eligible for some school-administered aid. For example, the UMaine Black Bear Exchange offers free food and resources to students close to Orono, and the UMaine Student Crisis Fund is accepting applications for awards from those impacted by the current pandemic.

Unfortunately, these resources can only go so far. The UMaine Student Crisis Fund, while accepting applications, is only able to give out fractions of what students request, in order to support the ever increasing number of students in need during this time. If college students were eligible for the relief checks, programs such as the Student Crisis Fund may not be as overwhelmed and could offer greater financial relief to students in greater need.

As an editorial board composed of college students, the Maine Campus dedicates itself to advocating for issues that impact our community. Many of us are living or observing the hardships students across the nation are facing in the time of the COVID-19 pandemic. Leaving college students out of government relief is a mistake that negatively impacts the lives of millions of young Americans. Moving forward, our government at both the state and federal level needs to do more to aid this demographic in need.